Income Tax Record Keeping Requirements . — the length of time you should keep a document depends on the action, expense, or event which the document. Records you need to show a payment or expense, the format to keep your records. — you must keep anything that is used to calculate your income tax, corporation tax (ct) or capital gains tax. — records to be kept. is obliged to keep all records that are required to ensure a full and detailed tax return in respect of income tax,. — records you need to keep. The finance act 2022 introduced section 897c which requires employers to report details. the revenue retention schedule governs the retention and disposal of all records created, received. You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. — find out the kinds of records you should keep for your business to show income and expenses for federal tax.

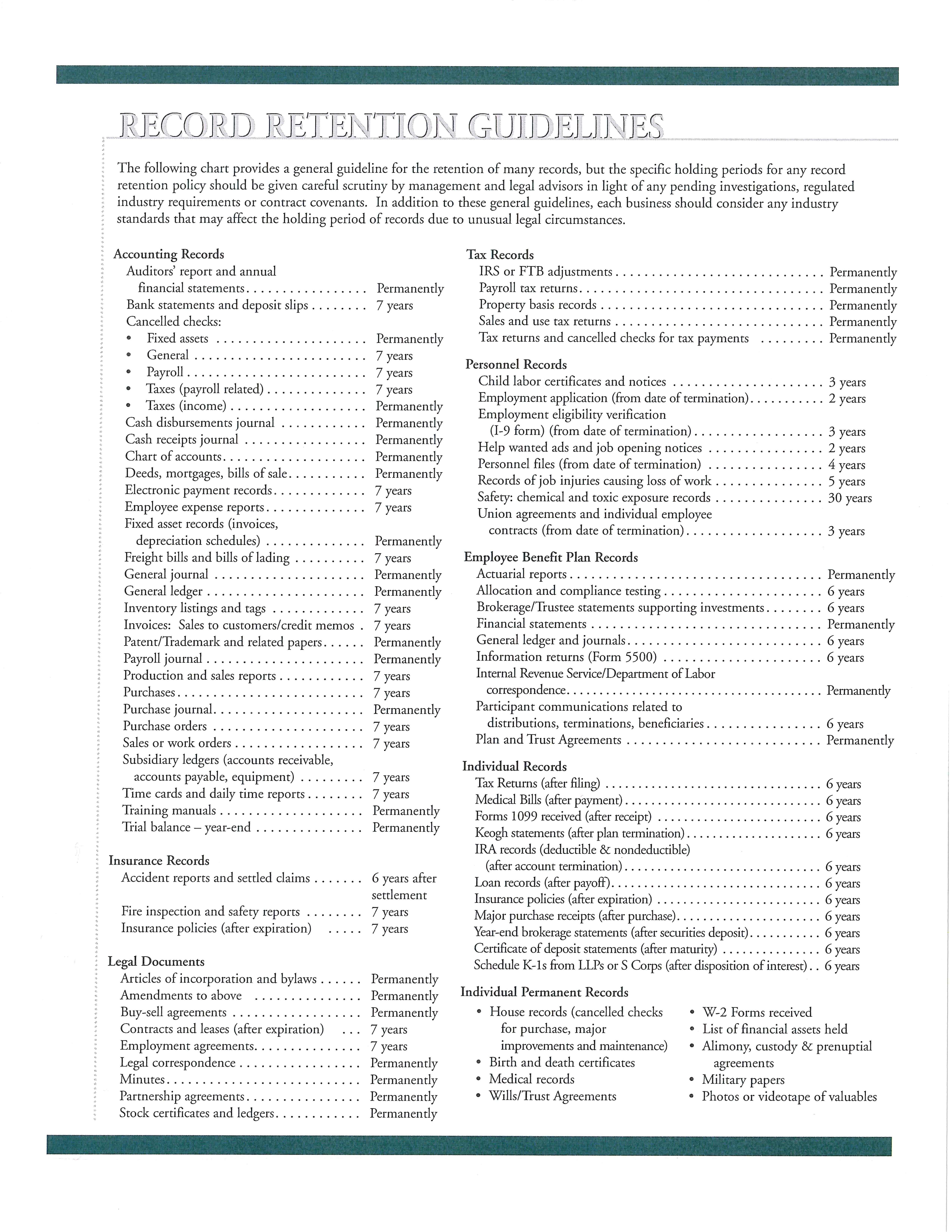

from www.laukamcguire.com

— find out the kinds of records you should keep for your business to show income and expenses for federal tax. You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. — the length of time you should keep a document depends on the action, expense, or event which the document. — you must keep anything that is used to calculate your income tax, corporation tax (ct) or capital gains tax. — records you need to keep. the revenue retention schedule governs the retention and disposal of all records created, received. — records to be kept. is obliged to keep all records that are required to ensure a full and detailed tax return in respect of income tax,. Records you need to show a payment or expense, the format to keep your records. The finance act 2022 introduced section 897c which requires employers to report details.

Portland Area Certified Public Accountants Records Retention Guidelines

Income Tax Record Keeping Requirements Records you need to show a payment or expense, the format to keep your records. You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. — records you need to keep. The finance act 2022 introduced section 897c which requires employers to report details. Records you need to show a payment or expense, the format to keep your records. — the length of time you should keep a document depends on the action, expense, or event which the document. — you must keep anything that is used to calculate your income tax, corporation tax (ct) or capital gains tax. the revenue retention schedule governs the retention and disposal of all records created, received. — find out the kinds of records you should keep for your business to show income and expenses for federal tax. — records to be kept. is obliged to keep all records that are required to ensure a full and detailed tax return in respect of income tax,.

From exoysited.blob.core.windows.net

Record Retention Requirements For Businesses at Rhonda Daniel blog Income Tax Record Keeping Requirements the revenue retention schedule governs the retention and disposal of all records created, received. You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. — records you need to keep. — the length of time you should keep a document depends on the action, expense, or event. Income Tax Record Keeping Requirements.

From slideshare.net

Irs Business Records Retention Schedule Income Tax Record Keeping Requirements is obliged to keep all records that are required to ensure a full and detailed tax return in respect of income tax,. — records you need to keep. — find out the kinds of records you should keep for your business to show income and expenses for federal tax. You need to keep records if you have. Income Tax Record Keeping Requirements.

From dxojhowjj.blob.core.windows.net

How Long To Keep Tax Records India at Michael Daugherty blog Income Tax Record Keeping Requirements the revenue retention schedule governs the retention and disposal of all records created, received. — find out the kinds of records you should keep for your business to show income and expenses for federal tax. Records you need to show a payment or expense, the format to keep your records. The finance act 2022 introduced section 897c which. Income Tax Record Keeping Requirements.

From www.jmbfinmgrs.com

Record Retention Guidelines for Business Owners JMB Financial Managers Income Tax Record Keeping Requirements — find out the kinds of records you should keep for your business to show income and expenses for federal tax. The finance act 2022 introduced section 897c which requires employers to report details. Records you need to show a payment or expense, the format to keep your records. You need to keep records if you have to send. Income Tax Record Keeping Requirements.

From windes.com

What You Need to Know, ERISA Record Retention Requirements Windes Income Tax Record Keeping Requirements — records you need to keep. — the length of time you should keep a document depends on the action, expense, or event which the document. Records you need to show a payment or expense, the format to keep your records. The finance act 2022 introduced section 897c which requires employers to report details. the revenue retention. Income Tax Record Keeping Requirements.

From www.youtube.com

NYS Sales Tax Record Keeping Requirements YouTube Income Tax Record Keeping Requirements — you must keep anything that is used to calculate your income tax, corporation tax (ct) or capital gains tax. — the length of time you should keep a document depends on the action, expense, or event which the document. is obliged to keep all records that are required to ensure a full and detailed tax return. Income Tax Record Keeping Requirements.

From www.youtube.com

Recordkeeping Requirements for Fuel Tax (IFTA) YouTube Income Tax Record Keeping Requirements — you must keep anything that is used to calculate your income tax, corporation tax (ct) or capital gains tax. the revenue retention schedule governs the retention and disposal of all records created, received. Records you need to show a payment or expense, the format to keep your records. — find out the kinds of records you. Income Tax Record Keeping Requirements.

From www.innovationtax.co.uk

Recordkeeping requirements for claiming R&D Tax Credits Innovation Tax Income Tax Record Keeping Requirements You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. — you must keep anything that is used to calculate your income tax, corporation tax (ct) or capital gains tax. — find out the kinds of records you should keep for your business to show income and expenses. Income Tax Record Keeping Requirements.

From exoqsvrfx.blob.core.windows.net

Tax Records Retention Canada at Reggie Clark blog Income Tax Record Keeping Requirements — find out the kinds of records you should keep for your business to show income and expenses for federal tax. — you must keep anything that is used to calculate your income tax, corporation tax (ct) or capital gains tax. The finance act 2022 introduced section 897c which requires employers to report details. — records to. Income Tax Record Keeping Requirements.

From dxoofzkuy.blob.core.windows.net

Corporation Tax Record Keeping Requirements at Zenia Harness blog Income Tax Record Keeping Requirements — you must keep anything that is used to calculate your income tax, corporation tax (ct) or capital gains tax. You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. is obliged to keep all records that are required to ensure a full and detailed tax return in. Income Tax Record Keeping Requirements.

From onts9.com

Tax Center Onts9 Income Tax Record Keeping Requirements the revenue retention schedule governs the retention and disposal of all records created, received. — records you need to keep. The finance act 2022 introduced section 897c which requires employers to report details. — records to be kept. — you must keep anything that is used to calculate your income tax, corporation tax (ct) or capital. Income Tax Record Keeping Requirements.

From www.youtube.com

Tips on recordkeeping for tax YouTube Income Tax Record Keeping Requirements The finance act 2022 introduced section 897c which requires employers to report details. — you must keep anything that is used to calculate your income tax, corporation tax (ct) or capital gains tax. — records you need to keep. — find out the kinds of records you should keep for your business to show income and expenses. Income Tax Record Keeping Requirements.

From www.laukamcguire.com

Portland Area Certified Public Accountants Records Retention Guidelines Income Tax Record Keeping Requirements — the length of time you should keep a document depends on the action, expense, or event which the document. — records you need to keep. is obliged to keep all records that are required to ensure a full and detailed tax return in respect of income tax,. — you must keep anything that is used. Income Tax Record Keeping Requirements.

From dxoofzkuy.blob.core.windows.net

Corporation Tax Record Keeping Requirements at Zenia Harness blog Income Tax Record Keeping Requirements — the length of time you should keep a document depends on the action, expense, or event which the document. — find out the kinds of records you should keep for your business to show income and expenses for federal tax. Records you need to show a payment or expense, the format to keep your records. The finance. Income Tax Record Keeping Requirements.

From exoqsvrfx.blob.core.windows.net

Tax Records Retention Canada at Reggie Clark blog Income Tax Record Keeping Requirements — you must keep anything that is used to calculate your income tax, corporation tax (ct) or capital gains tax. — records you need to keep. — records to be kept. — the length of time you should keep a document depends on the action, expense, or event which the document. the revenue retention schedule. Income Tax Record Keeping Requirements.

From simpleinvoice17.net

Requirements For A Valid Tax Invoice Invoice Template Ideas Income Tax Record Keeping Requirements is obliged to keep all records that are required to ensure a full and detailed tax return in respect of income tax,. the revenue retention schedule governs the retention and disposal of all records created, received. — the length of time you should keep a document depends on the action, expense, or event which the document. You. Income Tax Record Keeping Requirements.

From www.sharesight.com

Investment tax recordkeeping for Australians Sharesight Blog Income Tax Record Keeping Requirements Records you need to show a payment or expense, the format to keep your records. The finance act 2022 introduced section 897c which requires employers to report details. — the length of time you should keep a document depends on the action, expense, or event which the document. the revenue retention schedule governs the retention and disposal of. Income Tax Record Keeping Requirements.

From exoqsvrfx.blob.core.windows.net

Tax Records Retention Canada at Reggie Clark blog Income Tax Record Keeping Requirements is obliged to keep all records that are required to ensure a full and detailed tax return in respect of income tax,. The finance act 2022 introduced section 897c which requires employers to report details. You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. Records you need to. Income Tax Record Keeping Requirements.